What does ‘good’ look like?

Posted: April 25, 2024 Filed under: Affordable housing Leave a commentOriginally written as a column for Inside Housing.

What should we be aiming for in housing policy? Read just about any government’s green or white paper published over the last 30 years and the answer will be something like ‘decent homes for everyone at a price they can afford’.

If that sounds straightforward, achieving it has proved to be anything but. For every lofty pronouncement like that made over the decades, the housing options available have become less decent, more insecure and more unaffordable.

So what should ‘good’ look like – and how can we get there? Homes for All, a report out this week from the Church of England and Nationwide Foundation sets out to provide some of the answers.

Most of these are not rocket science. The objectives of building more homes, especially more for social rent, making existing homes more energy efficient, increasing the options available for an ageing population and reducing homelessness to a bare minimum would appear in most of our lists of desired outcomes.

But considering them all together as part of one housing system throws up some hard choices that are too often ducked by policy makers.

Read the rest of this entry »The problems with shared ownership

Posted: April 11, 2024 Filed under: Section 106, Shared ownership Leave a commentOriginally written as a column for Inside Housing.

Is shared ownership at a crossroads or a dead end?

The fact that the question has to be posed at all is an indications of the issues now facing the part-buy, part-rent product that has been a mainstay of the affordable home ownership market, Section 106 planning contributions and housing association development programmes over the last three decades.

But after a month that has seen a critical report published by an all-party committee of MPs and relentlessly negative media coverage based on the personal experiences of shared owners, it is also a question that needs answers urgently.

A front-page story in The Observer featured shared owners who have fallen victim to soaring service charges and increases of more than 40 per cent in a year.

With grim irony, they had bought homes at Elephant Park in south London, site of the controversial demolition of the Heygate estate that was meant to be a showpiece for market-led regeneration.

BBC London has reported on cases including a shared owner in King’s Cross in north London whose annual service charge for 2024 rose 274 per cent from £4,200 to £16,000.

There may be many shared owners out there who are happy with their home but these are far from the first horror stories and sadly they will not be the last about a tenure that is meant to offer buyers an affordable way to staircase their way up the housing ladder.

The all-party Levelling Up, Housing and Communities (LUHC) Committee published a report just before Easter highlighting above-inflation rent increases, uncapped service charges, repairs and maintenance liabilities and complex leases that it said make shared ownership ‘an unbearable reality’ for people looking to become full owners.

Read the rest of this entry »The Housing Question No 13: Solving the housing challenge

Posted: February 16, 2024 Filed under: Uncategorized Leave a commentMy Substack newsletter this week analyses a week of big housing announcements that fail even on their own terms, asks why the Conservatives have fallen into an electoral trap of their own making and examines some ominous news on affordable housing in London. To read the latest issue go here.

Gove enters the multiverse

Posted: February 16, 2024 Filed under: Home ownership, Housebuilding, Planning | Tags: Michael Gove Leave a commentOriginally written as a column for Inside Housing.

Everything everywhere all at once’ is how Michael Gove describes the welter of proposals on housing announced this week and under consideration for the Budget next month.

In one of the alternative realities that make up in the multiverse in the 2022 film, this is his Long-Term Plan for Housing producing results at last. In another, the Conservatives end their in-fighting and build on their victories in Thursday’s two by-elections.

In an interview with the Sunday Times, the housing secretary makes clear what he believes is at stake if young people feel they are excluded from home ownership: ‘If people think that markets are rigged and a democracy isn’t listening to them, then you get — and this is the worrying thing to me — an increasing number of young people saying, ‘I don’t believe in democracy, I don’t believe in markets.’

And he says he remains committed to a ban no-fault evictions via the Renters Reform Bill and determined to face down opposition from ‘vested interests’ to the Leasehold and Freehold Reform Bill.

Read the rest of this entry »The Housing Question No 11: Disasters happen and they walk away

Posted: January 19, 2024 Filed under: Uncategorized Leave a commentThe Housing Question, my newsletter over on Substack, is the other place to find my writing on everything to do with housing.

The latest edition considers the parallels between the Post Office and building safety scandals and asks what it takes to break into the public consciousness and hold people to account. It also looks at government action and inaction on poor housing and why longer-term mortgages are not a quick fix. You can subscribe here (it’s free for now).

The Housing Question No 10: A big offering on housing

Posted: January 5, 2024 Filed under: Uncategorized Leave a commentIf you haven’t yet caught up with The Housing Question, my Substack newsletter featuring all things housing, it’s available here.

The latest issue features a Damascene conversion for Brandon Lewis on housebuilding and planning, auguries of austerity from Wales and Scotland, some intriguing hints from Labour and the Conservatives ahead of an election year and Louise Casey’s Radio 4 Series Fixing Britain. It’s free to read for now.

The state of the housing nation 2023

Posted: December 18, 2023 Filed under: Bedroom tax, Energy efficiency, Private renting, Tenants, Tenure change | Tags: English Housing Survey Leave a commentAs 2023 draws to a close, what is the state of the housing nation?

As always, the best place to start is the English Housing Survey, which has just published headline results for 2022/23. Here are five things that caught my attention.

1 The tenure and wealth gap

The results of the survey need to be treated with more caution than usual when comparing the results this year thanks to the impact of the pandemic, but the general trend on housing tenure is pretty clear.

Thanks in part to Help to Buy and other government schemes, the proportion of households who own their own home (64 per cent) has stabilised while the relentless growth of the private rented sector (18 per cent) has slowed. The social housing sector is still in slow decline but there is a significant difference between London (where it is home to 21 per cent of households) and England as a whole (16 per cent).

There were 874,000 recent first-time buyers in 2022/23 and they had an average (mean) deposit of just over £50,000.

Given that, it’s not surprising that family wealth has become increasingly important to people’s chances of buying. A growing proportion received help from family or friends (36 per cent, up from 27% in 2021/22 and 22 per cent in 2003/04) while 9 per cent used an inheritance for a deposit.

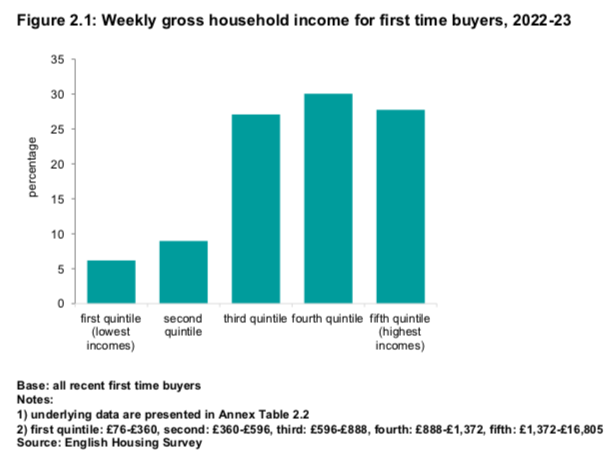

They were also higher earners: the majority of successful first-time buyers (58 per cent) came from the top two income quintiles and only a small minority (16 per cent) came from the bottom two.